Votre portail pour numériser vos services juridiques en ligne

Industrialisez vos workflows juridiques quelque soit votre langue ou la législation applicable.

Bénéficiez du meilleur des fonctionnalités dédiées aux juristes et personnalisables selon votre savoir-faire.

Alf votre solution pour industrialiser vos dossiers juridiques

Votre marketplace juridique

Personnalisez facilement votre portail dans toutes les langues grâce à une ergonomie intuitive et no-code

- Choisissez parmi +50 fonctionnalités juridiques complètes et à la carte

- Décidez du degré d’automatisation à chaque étape nécessaire de vos dossiers

- Invitez votre équipe et vos clients

- Suivez l’avancement de vos dossiers en temps réel

- Analysez vos résultats et pilotez facilement votre activité

Pour les TPE comme pour les grands comptes, Alf s'adapte selon vos besoins d'innovation.

Alf simplifie votre quotidien pour vous faire

gagner une journée chaque semaine !

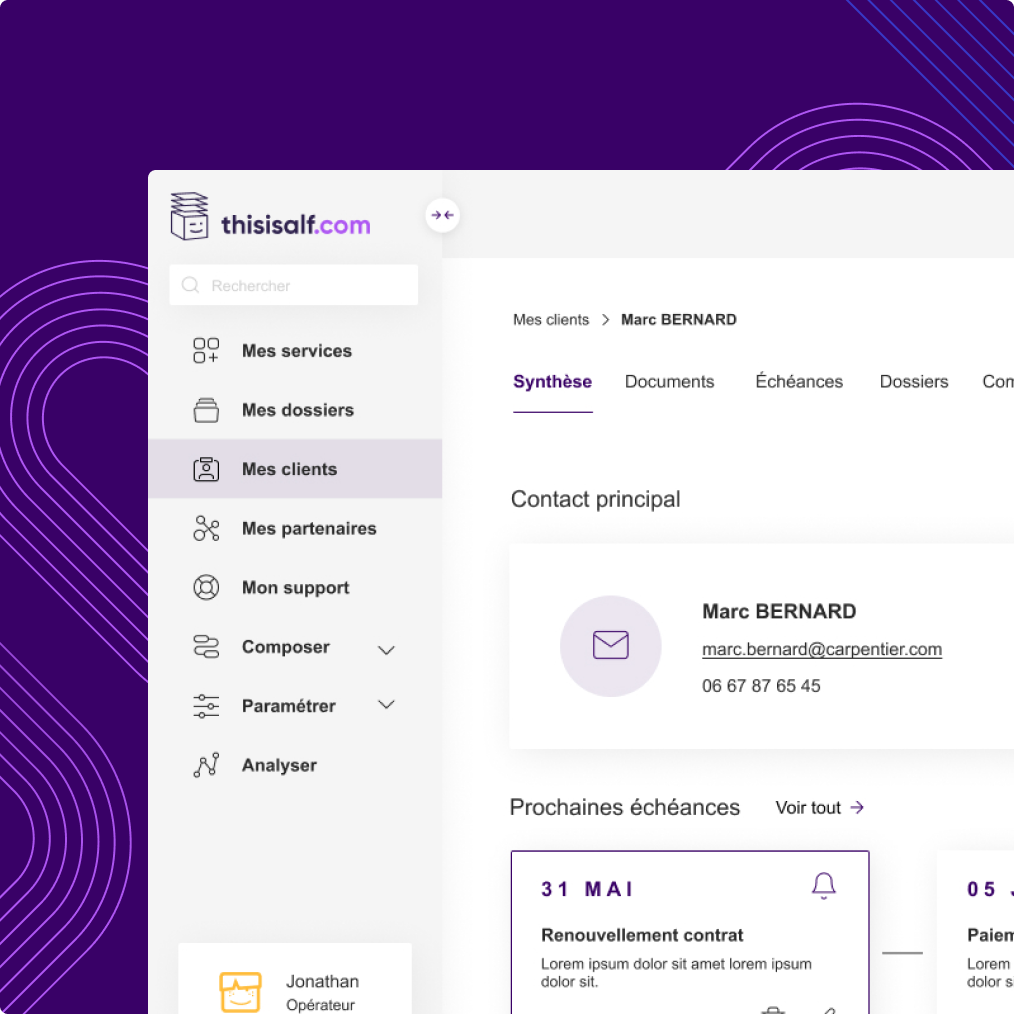

Fidélisez vos interlocuteurs

Améliorez l'expérience de vos clients et de votre équipe

Proposez un portail unique à votre image pour suivre vos dossiers, retrouver vos documents et donnnées utiles et collaborer facilement.

- Espace utilisateur ou client sécurisé

- Portail en marque grise ou en marque blanche

- Tous vos dossiers dans un tableau de bord unique

- Accès selon le rôle de chacun

- Fonctionnalités collaboratives et intuitives

- Rapports intelligents automatisés

Portail juridique tout-en-1

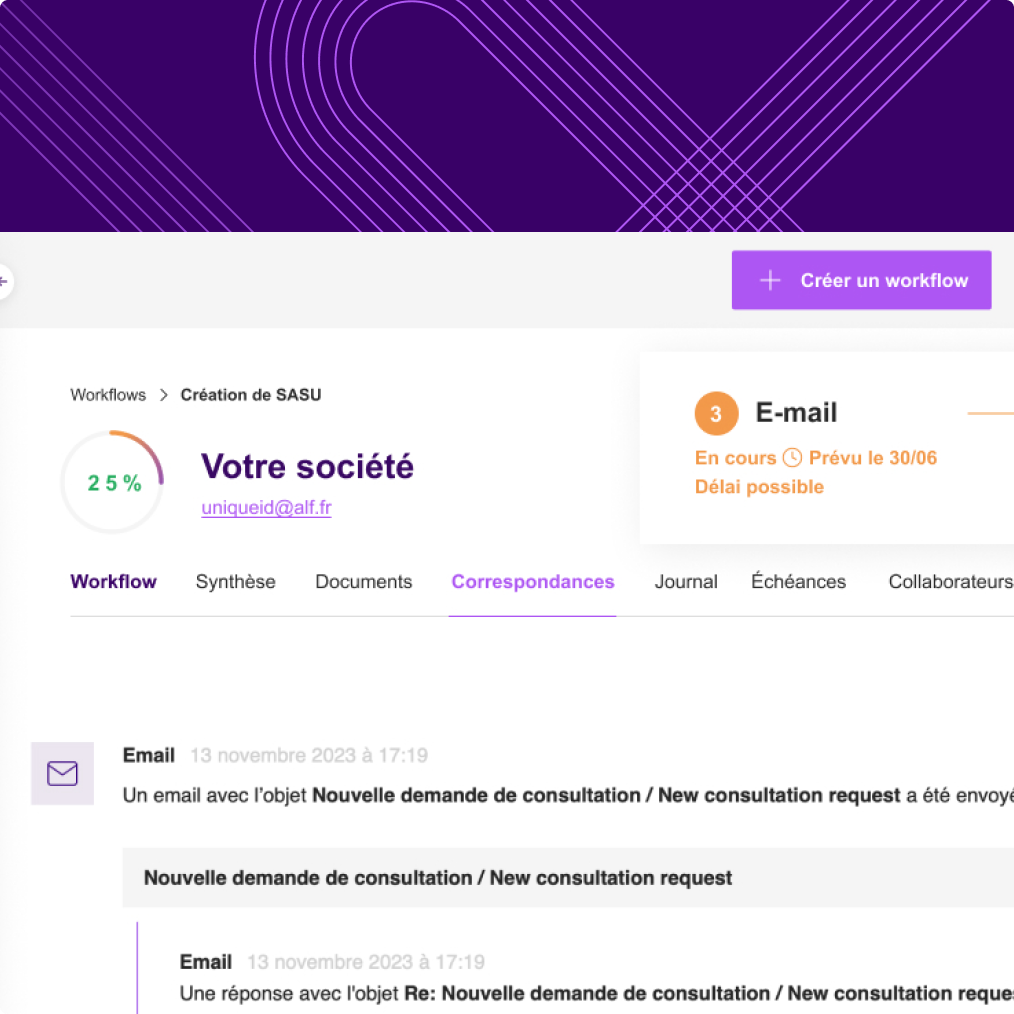

Simplifiez le suivi de vos dossiers

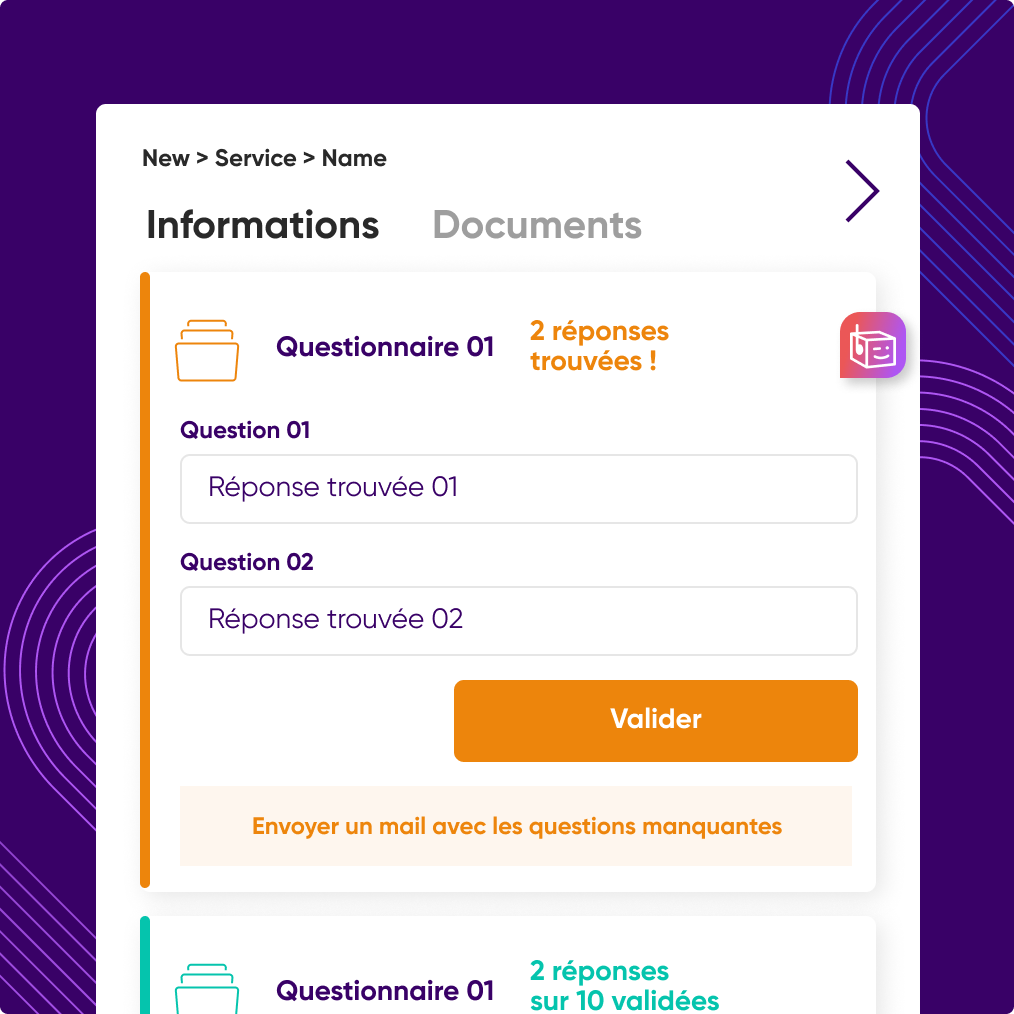

Comme nos clients, supprimez vos irritants et tâches répétitives à faible valeur ajoutée grâce à :

- Pré-génération de vos projets de documents récurrents, éditables

- Renommage automatique des documents

- Classement intelligent et harmonisé des documents

- Complétion automatique dans vos documents des informations déjà disponibles dans vos bases internes et/ou à partir des bases de données publiques

- Historique de tous les évènements d’un dossier (emails, documents, calendrier etc…)

- Alertes paramétrables

- Calendrier dynamique et partagé des échéances

Portail innovant pour le juridique

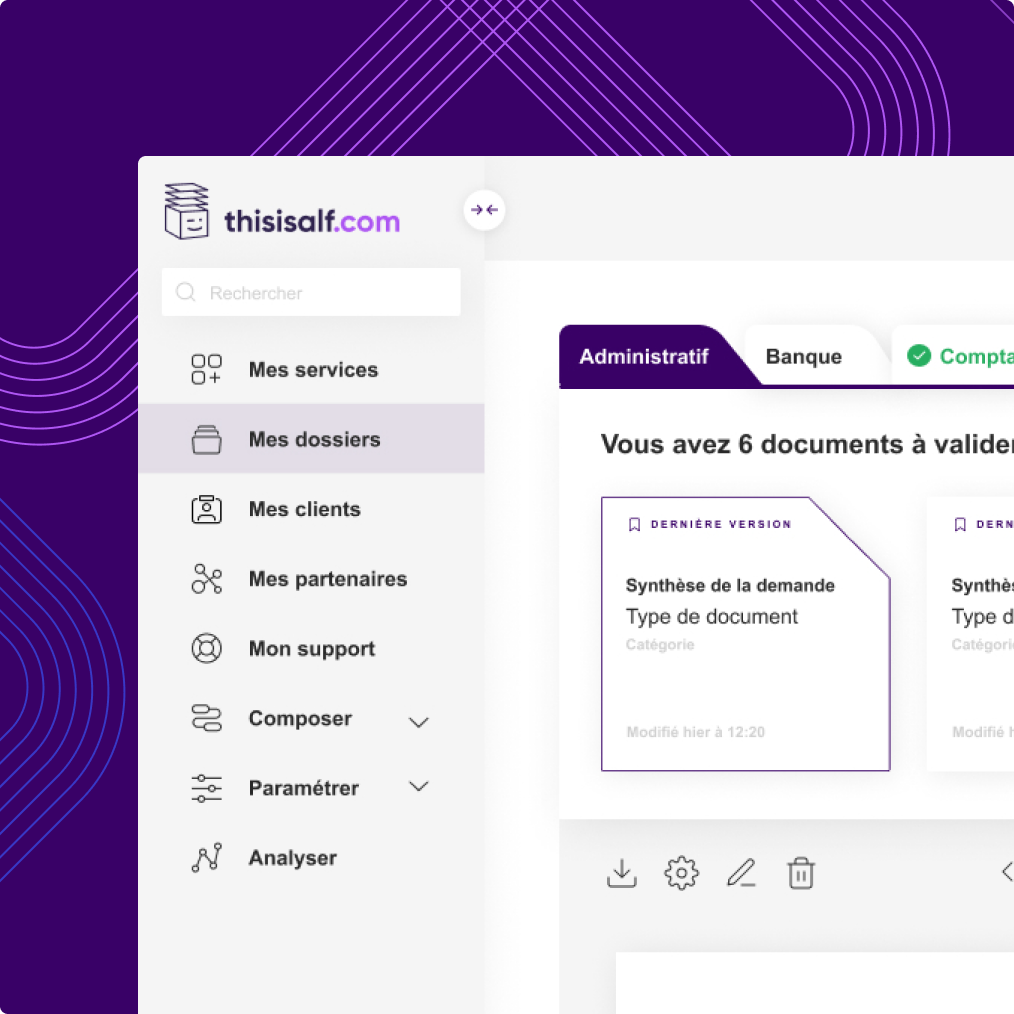

Boostez vos équipes grâce à l'automatisation et à l'IA

Alf met à la disposition des professionnels du droit du monde entier le meilleur de l’innovation.

- Connectez votre IA pour accélérer le contenu, le suivi et la gestion de vos dossiers

- Utilisez l’OCR pour extraire vos données dans vos documents

- Connectez vos outils métiers et travaillez sur une interface unique

- Harmonisez vos pratiques, partagez votre savoir-faire, et fidélisez vos équipes

Le premier portail juridique complet

Gardez le contrôle de vos dossiers juridiques

Que vous souhaitiez tout automatiser ou seulement une partie de votre activité, choisissez votre degré d’automatisation et intégrez vos outils métiers.

- Accompagnement legalTech et legalDesign adapté à vos besoins

- Co-construction de votre portail juridique avec votre équipe

- Support expert dédié à votre projet

- Nos fonctionnalités s’adaptent à votre savoir-faire et non pas l’inverse

Tous vos services juridiques en ligne

Ils utilisent Alf…

Votre temps est précieux

Alf supprime les irritants inutiles de votre quotidien

Pour les TPE comme pour les grands comptes, Alf s'adapte selon vos besoins d'innovation.